In a recent article, I shared a couple of nightmare sales and service experiences. Both of these examples were true stories that the Lodestar team personally experienced. Even though those bad calls left us cringing, they are important to examine as we can learn a lot about how to design better experiences.

One of the main takeaways from the examples is that technology can be used to set your staff up for success. Effectively harnessing your data into a solution that is easy for staff to use can ensure communication is timely, relevant and personal. A robust solution should allow employees to log interactions and track communications to be certain efforts are not being duplicated. Lastly, aggregating data from your disparate systems into a single platform will allow you to create a 360-degree view of your customer, providing quick insights into their channel preferences, product adoption, and so much more.

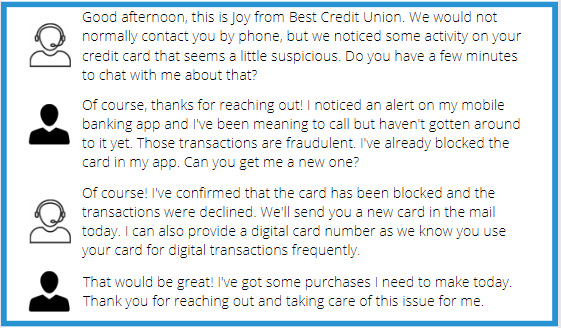

Now that we’ve focused on bad sales and service experiences and lessons that can be learned, let’s shift gears a bit. What does a good experience look like in real life?

While this is a short interaction, there are many examples of ways the credit union leveraged data to provide a delightful experience for both the staff member and the customer. What are some things the financial institution did right?

- Knowing the customer’s channel preferences – Starting the conversation off with “We would not normally contact you by phone” indicates that the FI knows the individual does not prefer to communicate through this channel, but this situation was important enough to warrant a call.

- Knowing the customer’s transaction behavior – Using technology to gain a sense of “normal” behavior allows the FI to detect when a transaction comes through that seems suspicious.

- Being prepared to resolve the matter quickly – The employee had clearly already prepared for the call and had all of the important information readily available. They were able to block the card, order a new one, and even provide a digital card number to minimize the impact for the customer.

When contrasting this experience to the two examples in the article, it is easy to see how good experiences lead to increased loyalty while bad experiences damage the relationship. After all, customers have many choices when it comes to their banking and you never know when one bad experience might be what sends them somewhere else.